11 Best Accounts Receivable Software for Businesses

Table of contents

When was the last time you looked at your accounts receivable and thought, “We’re leaving money on the table”?

For many businesses, that’s exactly what’s happening. Revenue is tied up in unpaid invoices, and while everyone talks about cash flow, the real issue often lies in how businesses are managing — or not managing their receivables.

The fact is, traditional methods are outdated. Relying on manual processes to track down payments is just inefficient. I know this first-hand because I’ve worked in a fintech before, and I’ve seen the kind of challenges companies face in tracking receivables manually.

This is exactly where an accounts receivable software can help.

They do the job of handling billing, collections, and even customer relationships. But how do you choose the right AR software for your business, when there are so many options available?

Let me guide you through the top 11 AR software solutions, breaking down their features and pricing so you can make the best choice for your business.

Table of Contents

- What is an accounts receivable software?

- 11 best accounts receivable software for businesses

- Best practices to select an accounts receivable software

- What are the key benefits of an accounts receivable software?

- Trends in accounts receivable software and how should businesses stay prepared

- Some frequently asked questions (FAQs) on accounts receivable software

- Select the right AR software

What is an accounts receivable software?

Accounts Receivable Software is a technological solution that helps businesses track money owed to them by customers. It manages unpaid invoices for goods or services already delivered.

For example, if a publishing company sells books to a retailer, and the retailer agrees to pay for them after 30 days, the amount owed by the retailer for the books is recorded as “accounts receivable” in the publishing company’s books.

An accounts receivable tool would help the publishing company track this debt, ensuring that the payment, when received, is properly recorded and that any delays or issues in payment are promptly identified and addressed.

11 best accounts receivable software for businesses

Here’s a quick comparison of the 11 best accounts receivable tools.

| Software | Key Features | Pricing |

|---|---|---|

| Hiver | Helps accelerate cash collection. Streamline incoming queries on invoice terms, compliance, and more. | Forever free plan Lite: $19/user/month Pro: $49/user/month Elite: $79/user/month |

| Tesorio | Automated Tracking, Credit and Collecting Payments, Invoice Matching. | Tailored pricing structures, demo required. |

| Gaviti | Invoice Management, Payment Forecasting, Automated Notices. | Standard, Pro, Expert Editions. |

| Billtrust | Dunning Management, Customizable Invoices, Billing Portal, Prioritized Worklists. | Pricing not specified. |

| Versapay | Online Payments, Omni-channel Platform, Invoicing, Cash Application. | Pricing not specified. |

| Quadient AR | Collections Management, Communications History, Invoice Delivery. | Pricing not specified. |

| BlackLine | Cash Application, Credit and Risk Management, Dispute and Deductions Management. | Pricing not specified. |

| HighRadius | Automated Dunning, Invoice Collection Metrics, Automated Invoice Status Tracking, Quick Dispute Resolution. | Pricing not specified. |

| Invoiced | Customer Management Portal, Structured Payment Plans Setup, API Access. | Plans start at $400/month. |

| BILL | Invoice Tracking, Automatic Payment Reminders, Auto-Pay features. | Essentials: $45/user/month Team: $55/user/month |

| Growfin | Tracking, Collaboration, Reporting, Collection Followup Bot. | Pricing not specified. |

1. Hiver

Hiver is a platform that helps teams simplify finance operations, especially accounts receivable. The best thing about Hiver is that it works inside Gmail and Outlook, and teams can get started without any extensive training. Hiver helps finance teams streamline communication with customers, track invoices, and manage payments easily.

Key Features:

- Centralized Communication: For finance teams working on accounts receivable, Hiver can help them easily manage all conversations around invoices and payments. It helps you centralize all communication, making it simpler to track and respond to payment-related issues.

- Collaboration Made Easy: Finance teams can collaborate on invoices, cash collection requests, and bookkeeping queries seamlessly. If there’s a query on an invoice term or a compliance issue, team members can simply @mention a colleague and write a note next to the email thread, asking for inputs or assistance.

- Automation for Efficiency: Hiver offers automation features that can be tailored to the needs of finance teams. For instance, repetitive tasks, such as sending out invoice reminders or categorizing incoming payment queries, can be automated, ensuring that the AR process is streamlined and error-free.

Pricing:

Hiver offers four types of pricing plans.

- Forever free plan

- Lite plan: $19/user/month

- Pro plan: $49/user/month

- Elite plan: $79/user/month

Free Trial: 7 days

“I absolutely love Hiver. Having the ability to have workflows and auto assignments, make it easier to manage ashared inbox. Having the ability to ‘close’ emails but easily access them later with tags makes it more efficient than having to scroll or search and hoping you can find what you were looking for. My last company had multiple teams in HR, Payroll, and Finance that had some shared functionality. Hiver made it easy to reroute emails that went to the wrong team without making the employees feel like they were being ping-ponged all over the company.”– Hiver User | G2 Review

2. Tesorio

Tesorio is an AI-powered platform tailored for accounts receivable management. It assists businesses in efficiently tracking and managing the money owed to them by their customers. By integrating with various ERP systems, Tesorio ensures every invoice is accurately tracked and followed up on.

Key Features:

- Automated Tracking: Tesorio keeps track of bills and payments automatically, making sure businesses know who owes them money.

- Checking Credit and Collecting Payments: The tool has features to check a customer’s credit and help businesses collect payments that are due.

- Matching Invoices: Tesorio makes sure that payments are matched with the right bills, so there’s no confusion about what’s been paid.

Pricing:

Tesorio provides adaptable and tailored pricing structures to suit businesses, regardless of their size. For a deeper understanding, you’ll have to schedule a demo in one of the following ways:

- Personalized 1:1 demo

- Group demo

- Recorded overview

- Interactive demo

“Tesorio has enabled us to fully automate our AR collections process, improving our AR aging and reducing the amount of manual work in heavy excel files. When compared forecasting for manual excel file vs Tesorio we could get exactly same results with +_ of 10% deviation which was almost perfect. It has reduced the reconciliations which were earlier prepared in excel to just one click in filters.” – Tesorio User | G2 Review

3. Gaviti

Gaviti is a dedicated platform designed to simplify and enhance the accounts receivable invoice-to-cash process. It offers businesses a clear and organized view of all billing activities, ensuring that every invoice is tracked and acted upon. With Gaviti, businesses can gain immediate insights into the status of their collections, making it easier to understand and act on their financial standing.

Key Features:

- Invoice Management: Gaviti allows businesses to efficiently manage and track all their invoices, ensuring that each one is accounted for and followed up on.

- Payment Forecasting: Gaviti uses data to predict when payments are likely to come in, helping businesses plan their finances better.

- Automated Notices: Gaviti automates the process of sending out reminders and notices for due payments, reducing manual effort and ensuring consistent communication with customers.

Pricing:

Gaviti provides three types of pricing plans.

- Standard Edition

- Pro Edition

- Expert Edition

“I like the visibility I get into our AR with Gaviti. I can take a high level picture on the dashboard or I can drill down into customers or invoices or specific aging buckets. Having the system distribute our invoices to our customers and send timely reminders has improved our DSO by 6 days. The implementation was painless, fast and efficient, and they are continually upgrading and making changes to help the users with the system.” – Gaviti User | G2 Review

4. Billtrust

Billtrust is a software solution dedicated to managing end-to-end customer payments. It offers businesses a centralized platform to handle their accounts receivable processes. The software’s AI engine offers predictions about when customers are likely to settle their invoices, giving businesses a clearer picture of their expected cash inflows.

Key Features:

- Dunning Management: Billtrust aids businesses in managing overdue payments, ensuring timely follow-ups and reducing the chances of bad debts.

- Customizable Invoices: Businesses can tailor their invoices to match their branding and specific requirements, ensuring clarity and professionalism in their billing processes.

- Billing Portal: Billtrust provides a dedicated portal for billing activities, allowing businesses and their customers to manage and view invoices in one centralized location.

- Prioritized Worklists: Billtrust helps businesses prioritize their collection activities, ensuring that high-value or overdue invoices are addressed first.

“We have been using Billtrust to process and distribute our invoices and to manage an AR portal. Our E-billing % is up to 72%, saving us postage and the time it takes our customers to get our invoices. More of our customers are using the portal to retrieve invoice copies and make payments. This cuts our administrative costs.” – Billtrust User Capterra Review

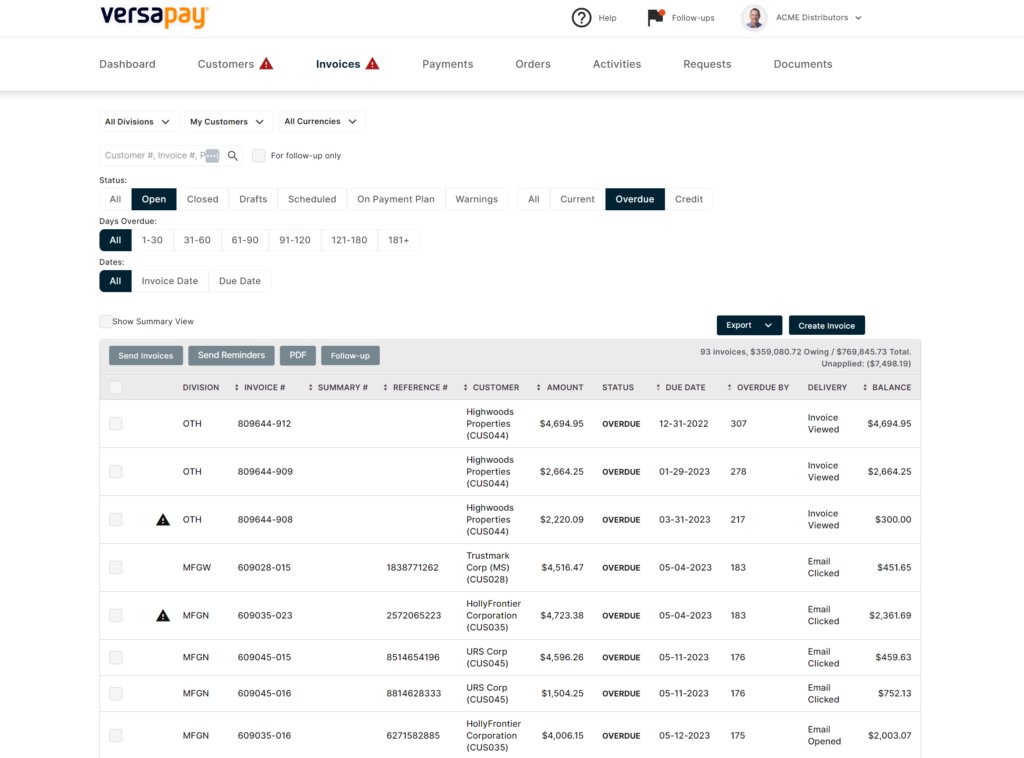

5. Versapay

Versapay is a suite of solutions designed to enhance and simplify the management of accounts receivable. Its collaborative approach to AR streamlines essential functions, from invoicing to payment processing, matching, and reconciliation. The AR automation platform also promotes real-time data sharing between internal teams and customers, which helps in speeding up the cash collection process.

Key Features:

- Online Payments: The platform provides a seamless online payment system, making it easier for customers to settle their invoices.

- Omni-channel Invoicing: Versapay supports multiple invoicing channels, catering to diverse customer preferences and ensuring that customers can pay invoices using the channel they are most comfortable with.

- Cash Application: With its advanced features and AI, Versapay can automatically match invoice numbers with payments, reducing manual effort and potential errors.

“Versapay automates all of the work of an AR Collector on a daily basis. This includes payments, and it eliminates a lot of unnecessary phone calls that we receive. It also sends invoices on a daily basis and sends us rejection notices of emails and invoices that do not get sent. This helps us tremendously in reducing our DSO. It is also a very user friendly system.” – Versapay User | G2 Review

6. Quadient AR – by YayPay

Quadient is a specialized platform that simplifies the credit-to-cash process for businesses, focusing on B2B invoicing. The tool not only automates invoicing and collection communications but also offers insights into predicting customer payment behaviors.

By assessing the creditworthiness of customers, businesses can make informed decisions about credit terms.

Key Features:

- Collections Management: Quadient AR aids businesses in efficiently managing their collections, ensuring that outstanding invoices are addressed promptly.

- Communications History: The platform provides a detailed history of all communication between companies and customers related to invoicing and collections, offering context to finance teams and driving transparency.

- Invoice Delivery: Quadient AR ensures that invoices are delivered promptly to the right customers at the right time, streamlining the billing process.

“I like the dashboard because it shows all of the pertinent aging information (DSO, total payments collected for the month, total outstanding invoices, etc.) with ease of access to the details of that data. Website is bright and easy to navigate. Very simple.” – Quadient AR User | Software Advice Review

7. BlackLine

BlackLine is a platform that helps boost the efficiency of your accounts receivable function. By focusing on eliminating manual processes and offering actionable insights, Blackline ensures that businesses can manage their receivables more effectively.

Furthermore, Blackline provides valuable recommendations for businesses on how to prioritize their customer invoices for better cash flow management.

Key Features:

- Cash Application: Blackline’s system is designed to automatically match customer payments with the correct invoices, reducing manual effort and potential errors.

- Credit and Risk Management: The platform offers tools to assess the creditworthiness of customers, helping businesses make informed decisions about credit terms and potential risks.

- Dispute and Deductions Management: The tool provides features to manage and resolve any disputes or deductions related to invoices, ensuring clarity and transparency throughout.

“Cash application is done in less than half of the time than our previous system/process. All remit advices are easily accessible on the site. Invoice suggestions make payment research so much easier and less time consuming.” – Blackline User | G2 Review

8. HighRadius

HighRadius offers an AI-enhanced solution, known as Autonomous Receivables, tailored to streamline the accounts receivable process for businesses. This platform focuses on automating tasks like invoicing, credit management, and cash reconciliation, ensuring that businesses can efficiently manage the money owed to them.

Key Features:

- Automated Dunning: HighRadius ensures that reminders for due payments are sent out automatically, reducing manual effort and ensuring consistent communication with customers.

- Collections Metrics: The platform provides detailed metrics related to collections, helping businesses understand their performance and areas of improvement.

- Automated Invoice Status Tracking: HighRadius keeps track of the status of each invoice, ensuring businesses are always updated on pending and settled invoices.

- Quick Dispute Resolution: HighRadius offers features to quickly address and resolve any disputes related to invoices.

“HighRadius is a great tool that provides automated solutions and customizable strategies for our collections team. This is also a great tool that allows us to track the progress and usage of our collectors.” – HighRadius User | G2 Review

9. Invoiced

Invoiced is a platform designed to offer a wide range of functionalities to manage accounts receivable processes. With Invoiced, businesses can streamline their invoicing and collection activities, ensuring timely payments and efficient communication with customers.

The platform also integrates seamlessly with popular accounting tools like QuickBooks and Xero, making data synchronization and management easier.

Key Features:

- Customer Management: Centralized system to manage customer invoicing details, payment histories, and communication logs, ensuring efficient tracking and follow-up.

- Payment Plans: Allows businesses to set up structured payment plans for customers, offering flexibility in payment terms and ensuring consistent cash inflow.

- API Access: Enables businesses to integrate and customize their accounts receivable processes, catering to specific invoicing and collection needs.

“Invoiced is a well-thought-out interface that is incredibly intuitive and easy for our customers to use. With the magic link, there is no username and password to create and remember. Customers get an emailed statement and/or invoice, and with a single click, they are on a payment page. So simple. We have seen a real growth in ACH utilization, which also saves us money. Customers can also see their payment history, use credits to pay for invoices, and see the original POS invoice from the time of service.” – Invoiced User | G2 Review

10. BILL

BILL is a comprehensive financial operations platform that emphasizes simplifying the accounts receivable process for businesses. With BILL, businesses can create professional invoices, offering them flexibility in how they’re sent, and receive payments directly to their bank accounts via methods like ACH or credit card.

Key Features:

- Invoice Tracking: Monitor the status of each invoice, ensuring businesses are always updated on pending and settled invoices.

- Automatic Payment Reminders: With BILL, businesses can set up automated reminders for outstanding invoices, ensuring regular communication with customers.

- Auto-Pay: This feature allows customers to set up automatic payments for their invoices, offering them convenience and ensuring businesses receive payments on schedule.

“I used to save all our invoices on a jump drive. I would have to scan the document to the drive and then save it in the appropriate file, and this would take valuable time. By inviting the vendors to set up epay, I no longer need to scan in invoices because the invoices are saved directly to Bill AP/AR! At first I was a bit leary on how I would see theinvoices, but as it turns out, I can easily find and see all bills paid and see all invoices with just a few clicks! So easy!”– BILL User | G2 Review

11. Growfin

Growfin is an AR automation platform designed to streamline collections, reduce manual effort, and accelerate cash flow for businesses. It integrates smoothly with leading ERPs like NetSuite, MS Dynamics, and SAP S4/HANA, invoicing platforms and payment processors like Chargebee, Zuora, and Stripe, and Banks including Bank of America and JP Morgan Chase.

Key Features:

- Automated Dunning: Automate follow-ups and collection strategies based on customer behavior and invoice status.

- Receivables Dashboard: Real-time insights into collection metrics, DSO trends, cash flow forecasts, and overdue invoices.

- Cash Application: Leverage AI/ML to auto-match payments with invoices, reducing unapplied cash and manual intervention.

- Dispute Management: Track and resolve disputes with a centralized view, ensuring quick resolutions.

- Customer Self-Service Portal: Customers can access account information, raise disputes, and provide PTPs.

- Collaboration Tools: Integrate with Slack, Salesforce and HubSpot to manage tasks, receive notifications, and collaborate on AR activities.

“Growfins limited sync time in pulling in all invoice data from ChargeBee has been a very seamless experience. The Integration and customization are very smooth. Workflow setup has been user-friendly and convenient to set up.”– Growfin User | G2 Review

Best practices to select an accounts receivable software

Here are some best practices to follow when selecting an accounts receivable software:

1. Assess your AR needs and processes: Firstly, evaluate your existing accounts receivable operations. The best way to do this is by gathering intel and input from your AR team. Find out about the roadblocks in collecting invoices. This will help you set clear objectives for the AR software you choose. And then answer these questions before moving to the next step:

- Which AR processes do you want to automate?

- What are the current pain points in your AR system or operations?

- Which features are must-haves, and which will be nice to have in your new software?

2. Evaluate AR software features: Once you understand your needs, research various AR automation solutions and compare their features. Look for software that automates key processes like invoice generation, payment reminders, collections prioritization and cash application. Some important features to evaluate:

- Automated invoicing and payment reminders

- Online payment acceptance and processing

- Integrated collections management

- Cash application and reconciliation

- Real-time reporting and analytics

3. Consider integration and customization features: Ensure the AR software you choose can integrate seamlessly with your existing systems like ERP, accounting and CRM. This will enable data to flow between applications and eliminate manual data entry. Also, look for software that allows you to customize workflows, create and share email templates, and track key metrics on collections. Flexibility is key, especially if you have complex billing models.

4. Assess vendor reputation and support: Compare the track record and customer reviews of different AR software vendors. Prioritize solutions from reputable providers who have a history of successful implementations. While doing this, you should also evaluate the level of implementation and ongoing support offered by each vendor. This includes training, onboarding assistance, and access to a knowledgeable support team.

5. Consider pricing and scalability: Pricing models for AR software vary, so compare the costs of different solutions. Some AR tools do not mention the cost upfront, so you have to take a free trial or contact the sales team to know the actual price. Also, inquire about any additional costs (such as training or onboarding new members).

Besides, it’s also important to assess the tool’s ability to handle increased invoice volumes/users, as your business grows. Cloud-based software often provides greater scalability than on-premise solutions.

6. Test the software: Before making a final decision, take advantage of free trials or demos to test drive the AR software yourself. Involve your AR team in the evaluation to get their feedback on usability and fit. Pilot the software with a subset of customers or invoices to assess its real-world performance. This will help you identify any issues or gaps before a full rollout.

Quick checklist for choosing the right AR software:

✅ Is the software easy to navigate?

✅ Does it connect smoothly with your current systems, like your ERP, CRM, or accounting software?

✅ Can it sync data automatically, so you don’t have to worry about duplicate entries?

✅ Is the software worth the price for the features it offers?

✅ Is support from the vendor available around the clock? Can you reach out to the support team via phone, email, or live chat?

✅ Can the software generate detailed reports that you can customize?

✅ Can it handle repetitive tasks automatically, like sending reminders for invoices or late payments? How much control do you have over what gets automated?

✅ Is it easy to add more users or upgrade to handle a higher volume of transactions?

✅ Does the software follow the latest security standards? Are there features to protect your data, like encryption and two-factor authentication?

What are the key benefits of an accounts receivable software?

Accounts receivable automation offers a range of benefits to businesses. Here are some key advantages:

- Enhanced accuracy: Automated calculations and data entry minimize human errors, ensuring accurate financial records. This reduces discrepancies and the time spent on reconciliations.

- Better customer relationships: With systematic follow-ups and reminders, businesses can maintain professional communication with clients. This leads to improved relationships and trust, as customers appreciate timely and accurate invoicing.

- Shortened sales-to-payment cycle: By streamlining the invoicing and payment process, accounts receivable software can significantly reduce the time it takes to receive payments after a sale.

- Improved communication: A/R management software enhances communication with customers by allowing you to review account information and create emails from one screen, saving time and improving service.

- Better cash flow: These softwares help businesses manage all the invoices and also keep a track of bills that are due. This way, timely collections happen which are good for maintaining a consistent cash flow for the business.

- Reporting and analysis: It gives a real-time visibility into financial health, helping businesses understand who owes money and how much.

Did You Know: Businesses that effectively manage their accounts receivable with automation can reduce their average Days Sales Outstanding (DSO) by up to 40%, accelerating cash flow.

Trends in accounts receivable software and how should businesses stay prepared

Check out these key trends for accounts receivable software and tips for businesses to be prepared.

1. Customer-centric payment experience: Focusing on the customer experience in AR means making it as easy as possible for customers to pay their invoices. This might involve offering multiple payment options, providing clear communication about what’s owed, or setting up a simple online payment portal. When customers find it easy to pay, they’re more likely to pay on time.

- Give customers the flexibility to pay in the way that works best for them, whether that’s by credit card, bank transfer, or digital wallet.

- Make sure your invoices are easy to understand and have all the information your customers need to make a payment.

- Use user-friendly online portals where customers can easily view and pay their invoices.

2. Predictive analytics: Predictive analytics uses data to help you make informed decisions about your accounts receivable. For example, it can help you predict which customers are likely to pay late or which ones might default on their payments. This allows you to take action before a problem arises, like offering payment plans or sending reminders earlier than usual.

- Start collecting more detailed data on your customers’ payment habits, and look at external factors like economic trends that might impact their ability to pay.

- Use software that can analyze this data and give you insights into potential risks and opportunities. This will help you manage your receivables more proactively.

3. Cloud-based AR solutions: Moving your AR operations to the cloud offers several benefits, such as being able to access your data from anywhere, reducing IT costs, and ensuring that you always have the latest software updates without having to manage them yourself.

- Select a cloud-based AR solution that meets your business needs and offers robust security features to protect your financial data.

- Make sure your team is comfortable using cloud-based systems, emphasizing the benefits of remote access and real-time updates.

- The cloud solution you choose should easily scale as your business grows, so that you don’t outgrow your technology too quickly.

4. Blockchain in receivables management: Blockchain technology offers a way to make transactions more secure and transparent by creating a digital ledger that cannot be tampered with. This is particularly useful in AR for preventing duplicate payments and reducing the risk of fraud.

- Look into how blockchain can be applied to your AR processes, especially if you deal with large volumes of transactions.

- Consider using smart contracts to automate payments and reduce the need for intermediaries. This can make your payment processes faster and more secure.

Some frequently asked questions (FAQs) on accounts receivable software

Here are some frequently asked questions about accounts receivable software for businesses.

1. Is accounts receivable software suitable for small businesses?

Absolutely. There are various accounts receivable tools that cater to the needs and budgets of small businesses, helping them manage finances more effectively without the need for extensive accounting knowledge.

2. How does this software handle late payments?

The software typically includes features for tracking overdue invoices and sending automated reminders to customers. It also offers reporting tools to analyze patterns in late payments.

3. Can accounts receivable software support multiple currencies?

Many accounts receivable software are designed to handle transactions in multiple currencies, which is particularly beneficial for businesses operating internationally.

4. Can accounts receivable software handle recurring billing?

Yes, many accounts receivable systems are equipped to handle recurring billing, automating the process for regular charges such as subscriptions or ongoing service fees.

5. Can the software be accessed remotely?

Many modern accounts receivable solutions are cloud-based, allowing users to access the system remotely from different devices, which is particularly useful for businesses with remote or mobile workforces.

Select the right AR software

Choosing the right tool to manage money coming into your business is really important. It can help you keep track of payments and make sure there is a steady inflow of cash.

Hiver is a good example of one such tool. It has all the powerful features to help you manage accounts receivable processes. But the best part is that it works inside Gmail and Outlook. Because of this, the setup is extremely simple, and there’s nothing complicated about the interface.

You can, therefore, start managing cash flows more efficiently without learning a whole new system!