Role of AI in Accounts Payable and Receivable

Table of contents

The smooth running of accounts receivable (AR) and accounts payable (AP) is crucial for any business. Yet, these crucial functions often get bogged down with repetitive tasks, piles of paperwork, and errors from manual data entry.

This is where artificial intelligence (AI) steps in to make a significant impact.

AI automation can take over repetitive tasks, reduce human error, and find valuable insights from large amounts of data. This results in smoother workflows, better cash flow management, and smarter financial decisions.

In this article, we’ll explore how AI can improve AP and AR and look at some tools that help streamline these processes.

Table of Contents

- Current challenges in Accounts Payable and Receivable

- How can AI streamline accounts payable operations

- How can AI streamline accounts receivable operations

- Top 6 Accounts Payable and Receivable tools for businesses

- Benefits of artificial intelligence in accounts receivable and payable

- Best practices to implement AI in AP and AR

- Future trends in AI for streamlining AP and AR operations

- Conclusion

Current challenges in Accounts Payable and Receivable

Managing AP and AR manually brings several challenges, such as:

| Pain Point | Description | Example |

|---|---|---|

| Manual Workflows and Inefficiencies | Tedious data entry and processing prone to errors and delays, Involves multiple handoffs between departments. | A typo in an invoice amount causes a $10,000 overpayment, which takes two weeks to resolve and disrupts cash flow. |

| Slow Processing Times | Delays in invoice approval and payment collection, straining supplier relationships and affecting cash flow. | An invoice sits in an approval queue for a week, resulting in a supply hold and financial loss due to a key manager being on vacation. |

| Fraud Risks and Compliance Issues | Difficulty in detecting fraudulent activities and ensuring compliance with regulations due to manual processes. | An employee approves fake invoices for months, causing financial losses and damaging the company’s reputation with investors. |

| Lack of Visibility | Limited real-time visibility into cash flow, hindering decision-making and strategic planning. | A company struggles to track outstanding payments and misses key insights into cash flow trends, which affects its ability to plan and allocate resources effectively. |

| High Operational Costs | Increased costs due to labor-intensive processes and the need for additional staff to manage manual tasks. | A business hires extra personnel to handle the high volume of invoices, leading to increased operational expenses without corresponding improvements in efficiency. |

| Inconsistent Payment Terms | Difficulty in managing and enforcing consistent payment terms with suppliers and customers, leading to cash flow issues. | A company faces challenges maintaining consistent payment terms, which resulted in disputes with suppliers and delays in receiving payments from customers. |

How can AI streamline accounts payable operations

Accounts Payable (AP) is a vital component of any business, ensuring suppliers and vendors are paid accurately and on time. Here’s how AI can streamline this process:

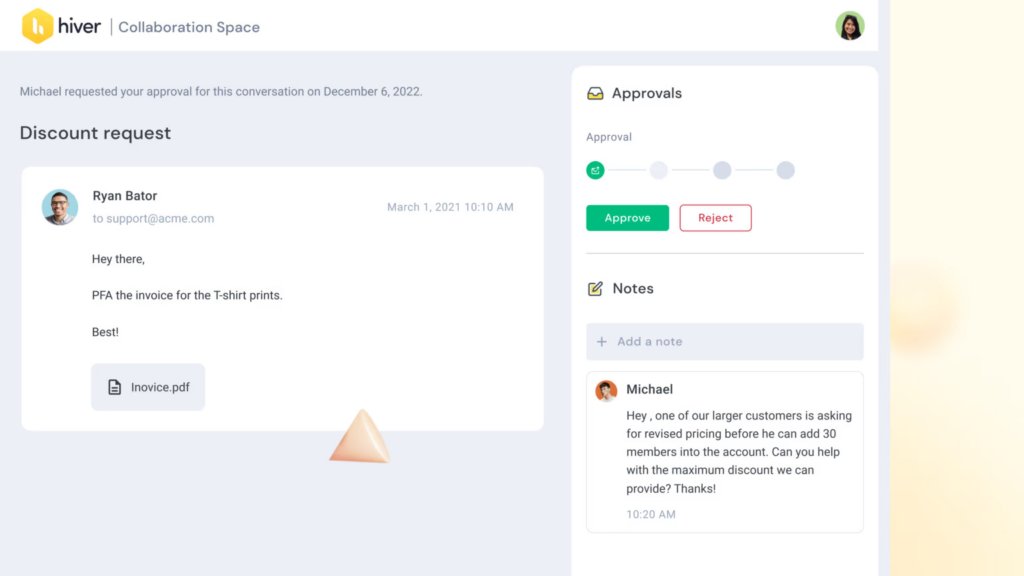

- Intelligent approval workflows: AI streamlines the traditional invoice approval process by automating the workflow, routing invoices to the appropriate approvers based on predefined rules and priorities. With Hiver, for instance, you can automate email workflows to get approvals on time and keep approval logs. Set up approval processes and add invoices to your ERP directly from your inbox.

- Fraud detection: AI detects fraud by analyzing transaction patterns and identifying anomalies that may indicate suspicious behavior. For example, if there is an unexpected spike in invoice amounts or payments to unfamiliar vendors, AI can flag these for further investigation.

- Smart invoice processing: Instead of manually inputting invoice details, AI can swiftly and accurately extract information such as invoice numbers, dates, amounts, and vendor details – with the help of AI-powered Optical Character Recognition (OCR) and machine learning algorithms.

- Supplier relationship management: AI tools optimize payment schedules by analyzing past payment behaviors and cash flow trends. For instance, AI can suggest the best times to make payments to take advantage of discounts or avoid late fees, strengthening supplier relationships.

How can AI streamline accounts receivable operations

Managing accounts receivable can be complex and time-consuming, with challenges such as manual invoice generation, tracking payments, and handling disputes with customers. AI can significantly streamline AR operations by automating these processes.

- Automated invoice generation and delivery: AI systems generate invoices based on transaction data, ensuring consistency and accuracy. For example, AI can automatically generate invoices at the end of each month, include all relevant transaction details, and send them to customers via email.

- Payment tracking and reconciliation Tracking incoming payments and reconciling them with outstanding invoices can be a labor-intensive task. AI simplifies this process by automatically matching payments to invoices, identifying discrepancies, and updating records in real-time.

- Predictive analytics for payment behavior: By examining patterns and trends, AI systems forecast which customers are likely to pay late and which might default. This predictive capability allows businesses to take proactive measures, such as sending early payment reminders to at-risk customers or adjusting credit terms.

- Intelligent dunning strategies: AI improves traditional dunning strategies by personalizing communication based on customer behavior. It segments customers by payment history and tailors messages, sending gentle reminders to occasional late-payers and firmer notices to customers who frequently miss payment deadlines.

Top 6 Accounts Payable and Receivable tools for businesses

Here are six tools and their key features that help streamline accounts receivable and payable operations:

1. Hiver

Hiver is an AI-powered platform designed to enhance collaboration and streamline communication for finance teams. It simplifies the management of vendor and customer interactions directly from your inbox.

Key Features:

- Accounts Receivable (AR) Collaborate with sales, legal, and account management to quickly answer customer questions and sort out invoices. Track and collect any overdue payments.

- Accounts Payable (AP) Handle emails about invoices, payments, and new vendors with ease. Set up approval flows and add invoices directly to your ERP from your inbox.

- Accounting: Close books faster and simpler. Work with other teams to see their budgets and cash flows clearly.

- Employee Help Desk Quickly respond to employee questions about reimbursements, taxes, travel, and payroll. Keep everyone updated on any policy changes.

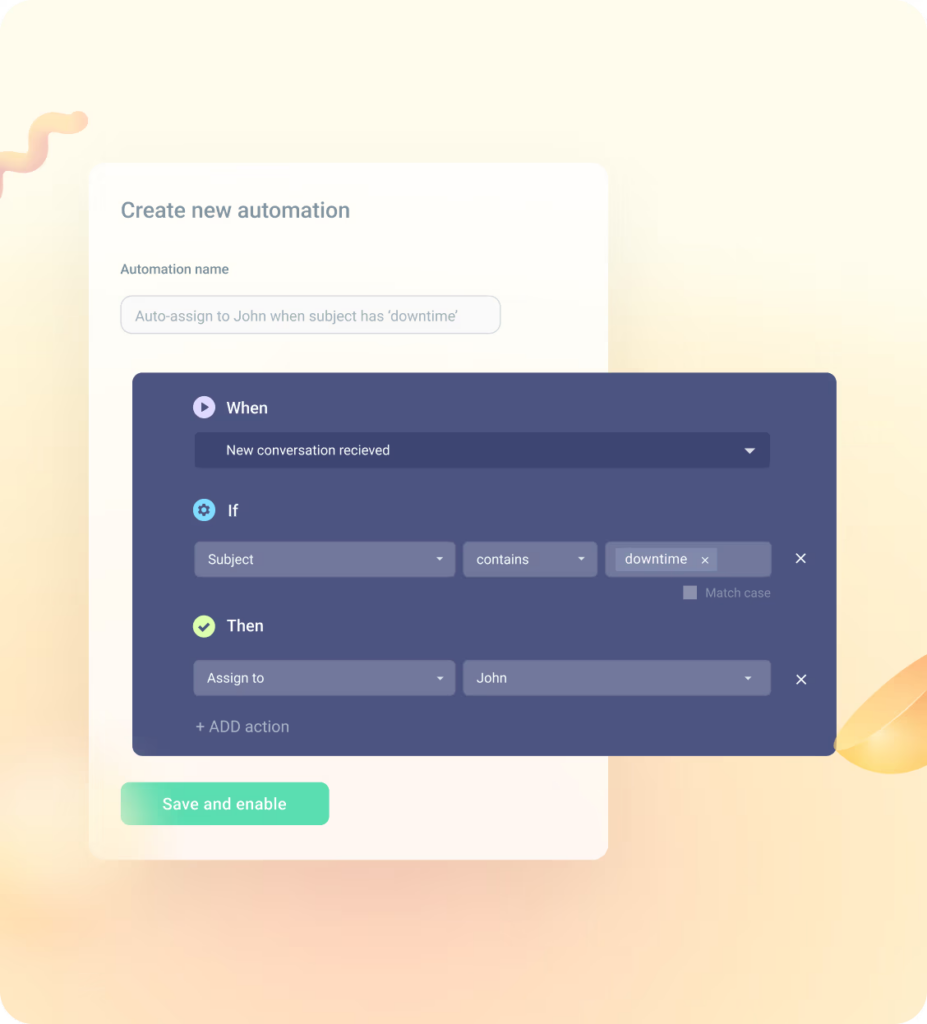

- Automation: Speed up email responses by automatically assigning emails to specific team members using set conditions. For example, emails with the word ‘Payment’ in the subject or body can go directly to finance specialists.

Take an interactive tour of Hiver

2. Tipalti

Tipalti offers a comprehensive solution that automates the entire AP process, from invoice capture to payment reconciliation. Its AI capabilities streamline workflows, ensure compliance, and enhance financial control.

Key Features:

- Automated Invoice Capture: Uses AI to recognize and extract data from invoices, reducing manual data entry.

- Intelligent Approval Routing: Automates the approval process by routing invoices based on amount, vendor, and other criteria.

- Payment Reconciliation: Matches payments with invoices automatically, ensuring accurate and timely record-keeping.

3. HighRadius

HighRadius leverages AI to optimize AR processes, focusing on credit risk assessment, collections, and dispute management. It helps businesses improve cash flow and reduce the risk of bad debt.

Key Features:

- Credit Risk Assessment: Uses AI to analyze customer data and predict credit risk, enabling informed decision-making.

- Automated Collections: Personalizes collection strategies based on customer behavior and payment history.

- Dispute Management: AI-driven workflows streamline the resolution of payment disputes, reducing the manual time and effort required for follow ups.

10 Best Accounts Receivable Software for Businesses

4. Yooz

Yooz specializes in automating AP workflows and ensuring compliance. Its AI-driven platform captures, processes, and approves invoices efficiently, enhancing accuracy and control.

Key Features:

- AI Invoice Capture: Automates data extraction from invoices using AI, reducing manual entry and errors.

- Workflow Automation: Intelligent routing of invoices for approval based on customizable rules.

- Compliance Assurance: Ensures all invoices meet regulatory and company standards, reducing compliance risks.9

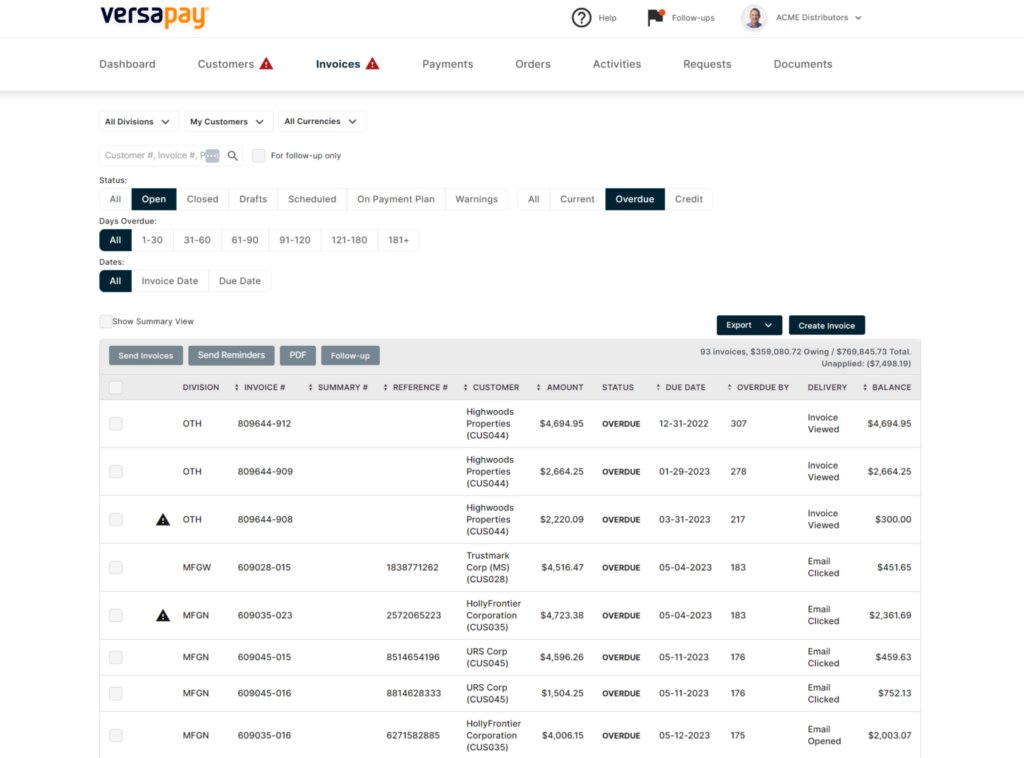

5. Versapay

Versapay is an AR automation platform that simplifies invoicing, payment processing, and cash application. It promotes real-time data sharing between teams and customers to speed up collections.

Key Features:

- Online Payments: Provides a seamless online payment system.

- Omni-channel Invoicing: Supports multiple invoicing channels.

- Cash Application: Automatically matches invoice numbers with payments, reducing manual effort.

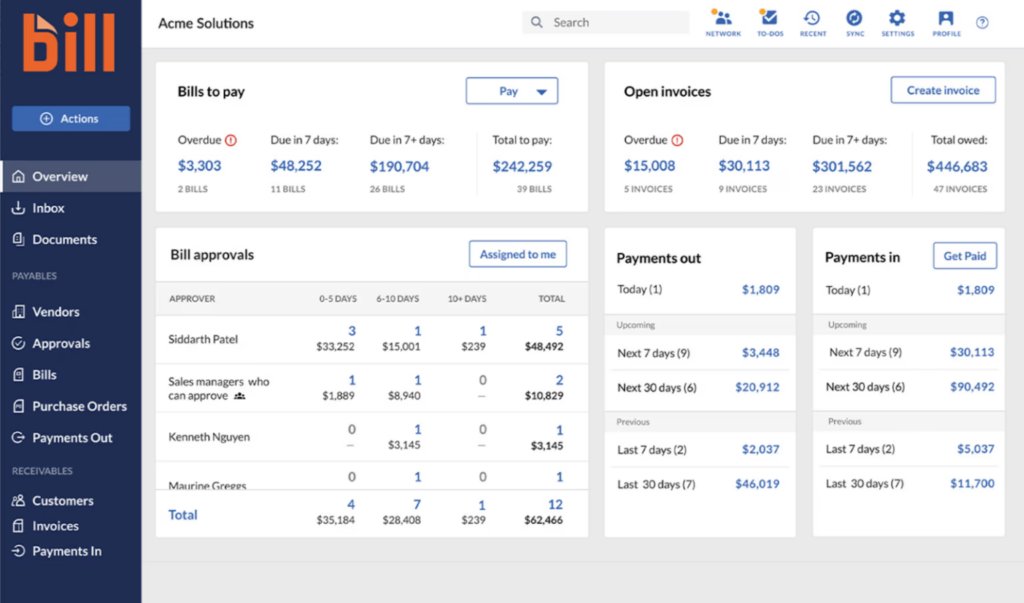

6. BILL

BILL is an AP automation platform that simplifies and streamlines the entire accounts payable process. It uses AI to automate various tasks, from invoice capture to payment processing, enhancing efficiency and accuracy.

Key Features:

- AI-Powered Invoice Capture: Automatically extracts and processes invoice data, reducing the need for manual data entry and minimizing errors.

- Automated Approval Workflows: Routes invoices to the appropriate approvers based on predefined rules, speeding up the approval process and reducing bottlenecks.

- Payment Scheduling: AI helps optimize payment schedules, ensuring timely payments to suppliers while managing cash flow effectively.

13 Best Accounts Receivable and Accounts Payable Software

Benefits of artificial intelligence in accounts receivable and payable

Here are some benefits:

- Efficiency and accuracy: AI handles repetitive tasks like data entry, invoice processing, and payment tracking, leading to fewer errors and faster operations.

- Cost savings: Using AI leads to significant cost savings as it helps cut down on errors, speed up processes, and optimize workflows. These improvements mean lower labor costs, fewer expenses correcting mistakes, and overall more efficient operations.

- Better cash flow management: AI improves cash flow management by accelerating invoice processing and payment collection. Automating these processes ensures timely customer payments and helps avoid late fees to suppliers. This leads to a more stable cash flow, enabling the business to operate smoothly and plan for the future without financial disruptions.

- Informed decision-making: AI provides valuable insights by analyzing patterns and trends in financial data. It can predict future financial scenarios and suggest optimization strategies. For instance, a tech startup can use AI to analyze its accounts receivable data. It can find out which customers are likely to delay payments and use this information to follow-up proactively or offer early payment discounts.

Best practices to implement AI in AP and AR

Implementing AI in AP and AR requires careful consideration of integration challenges, data privacy, and security, as well as effective change management strategies. Here are some best practices:

- Assessment and planning: Conduct a thorough assessment of existing systems and identify integration points. Develop a detailed implementation plan that outlines steps, timelines, and responsibilities.

- Pilot testing: Start with a pilot project to test the integration on a smaller scale. This helps identify potential issues and allows for adjustments before a full-scale rollout.

- Stakeholder engagement: Involve key stakeholders from the beginning of the project. Communicate the benefits of AI and address any concerns to gain their support.

- API utilization: Use Application Programming Interfaces (APIs) along with an API management gateway to facilitate seamless communication between AI tools and existing systems. APIs can simplify the integration process and enhance compatibility.

- Vendor collaboration: Work closely with AI vendors to ensure their tools are customized to fit your specific needs and existing infrastructure.

- Compliance with regulations: Ensure that AI tools comply with relevant data protection regulations such as GDPR, CCPA, and industry-specific standards.

- Access controls: Establish strict access controls to limit who can access financial data. Use multi-factor authentication and role-based access controls to enhance security.

- Regular audits: Conduct regular security audits and vulnerability assessments to identify and address potential security risks.

- Comprehensive training: Provide thorough training programs for all users. Ensure they understand how to use AI tools and are aware of the new workflows.

No extensive training required. Finance teams can get started with Hiver in minutes.

Future trends in AI for streamlining AP and AR operations

Here are some popular trends:

1. Predictive Analytics: Predictive analytics uses AI to analyze historical data and forecast future trends, enhancing decision-making in financial operations. In AP and AR, it can:

- Analyze past payment behaviors to identify customers likely to pay late and suggest proactive measures like sending reminders or adjusting credit terms.

- Help businesses maintain healthier cash flow and reduce the risk of bad debt by predicting payment delays.

- Provide insights into spending patterns, aiding in budget optimization and financial planning.

2. Hyper Automation: Combine AI with technologies like Robotic Process Automation (RPA) to automate entire processes. For AP and AR, AI handles tasks such as data extraction from invoices, while RPA takes over repetitive tasks like data entry, email responses, and workflow management.

Prediction: Hyper Automation will lead to seamless automation, reducing the need for human intervention and greatly increasing efficiency. An automated AP process could have AI extract invoice data, RPA enter this data into the ERP system, and then AI verify the accuracy and route it for approval.

3. Blockchain integration: Blockchain technology offers a secure and transparent way to handle transactions. Integrating blockchain with AI enhances the security and transparency of financial transactions, ensuring all actions are traceable and verifiable.

Use case: In AP, blockchain can create a transparent ledger of all transactions, while AI ensures the data entered is accurate and complete. This integration prevents fraud and errors since every transaction is recorded on a secure, immutable ledger. Similarly, in AR, blockchain can maintain a transparent record of all customer payments, boosting trust and accountability.

Conclusion

AI is making a big difference in accounts payable (AP) and accounts receivable (AR) by improving efficiency, accuracy, and decision-making. It handles tasks like smart invoice processing, automated approvals, and predictive analytics. This means your financial operations run smoother, and your business can grow faster.

If you want to stay competitive and improve how you manage finances, it’s time to look into AI solutions. Finding the right tool is key. Hiver is a great option that can help streamline all finance-related communication and approval workflows directly from your inbox.