7 Best Practices for Accounts Receivable (AR) Automation Software

Table of contents

Efficiency, accuracy, and optimized cash flow — these are the foundational goals of any finance team handling accounts receivable (AR). But managing accounts receivable traditionally requires a lot of manual work, such as:

- Creating invoices manually for each customer, including all necessary details and line items, and then sending them out.

- Sending manual payment reminders and collection notices to customers with overdue invoices.

- Manually entering invoice details and customer information into spreadsheets or accounting systems.

The problem is that doing these tasks manually leaves room for human errors — such as mistakes in data entry, delayed reminders, mismatched payments, and invoices — to name a few.

This is why businesses today are looking for solutions to help them automate the AR process and ensure finance processes run smoothly and without any errors. From invoice generation to sending reminders, AR automation tool can do a lot to streamline your accounts receivable.

This article will explore some best practices to optimize and make the most out of account receivable automation tools.

Table of Contents

- 1. Start with clean data and a billing blueprint

- 2. Train your employees extensively

- 3. Automate your workflows

- 4. Keep track of your key finance metrics

- 5. Improve cross-team collaboration

- 6. Ensure an up-to-date tech stack

- 7. Be more proactive with your customers

- Tips to Improve Accounts Receivable Collection

- Conclusion

1. Start with clean data and a billing blueprint

Before implementing the software, it’s important to have clean and accurate data to feed into your automation tool. Develop a blueprint of your invoices so that there are no discrepancies. This also minimizes the chances of any errors in your balance sheets.

Take a thorough look at your current accounts receivable data and ensure it’s ready to be fed to your AR automation software. For instance, you can start by:

- Consolidating your customer information

- Removing irrelevant information, such as information on churned customers

- Validating customer details

This step reduces errors and maintains data accuracy while using your accounts receivable automation software.

2. Train your employees extensively

To make the best out of your accounts receivable automation software – one of the most important steps is to train your employees on how to use the tool. This includes training on software functionalities, best practices, and relevant workflows.

With proper training, your employees can use the software to its full potential. They wouldn’t waste time and effort figuring out how things work on the platform.

However, most AR automation software comes with a complicated UI, making employee training a time-consuming process.

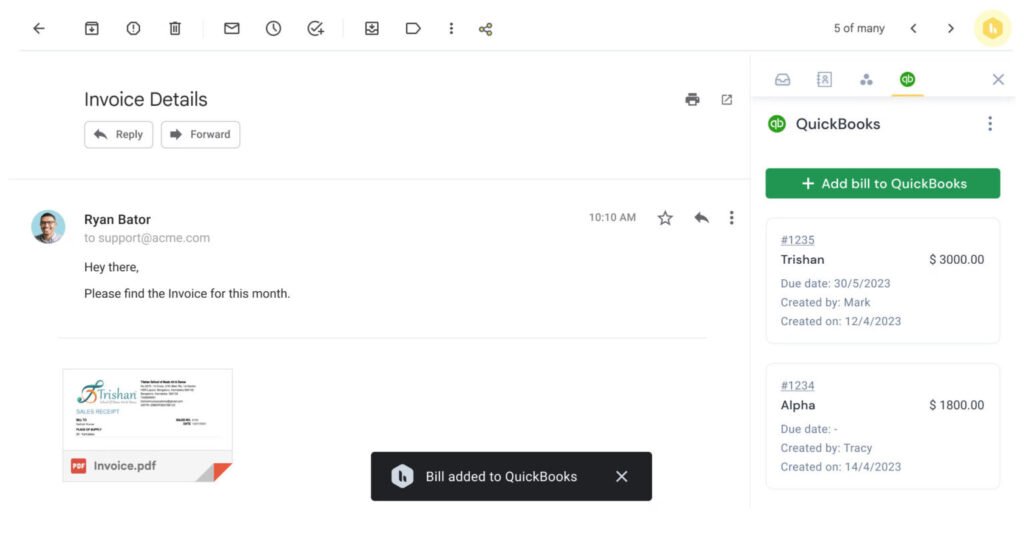

If you are looking for finance operations software that doesn’t require hours of training to get started, Hiver is a great option to consider. Hiver works on top of your Gmail inbox, which means your teams will work out of a very familiar interface. They can get started in the most hassle-free manner.

Here’s what Hiver’s users have to say about the platform:

“Hiver is user-friendly and easy to use. The dashboard set-up is pretty self-explanatory, and customer service has always been helpful and eager to solve whatever issue you may be having.”

“I really enjoy using Hiver. The intuitive layout makes the workflow smoother. I’m also incredibly impressed with the responsiveness of their customer service – it’s never been a problem to get in touch with them! ”

– User reviews on G2

3. Automate your workflows

Your AR automation software can take up your mundane, repetitive tasks and automate workflows to improve your team’s productivity. With automated workflows, you can ensure your staff doesn’t spend time and effort on manual tasks and work on more important things. Automation also ensures that there is no scope for error, which can be the case when you’re manually doing these tasks.

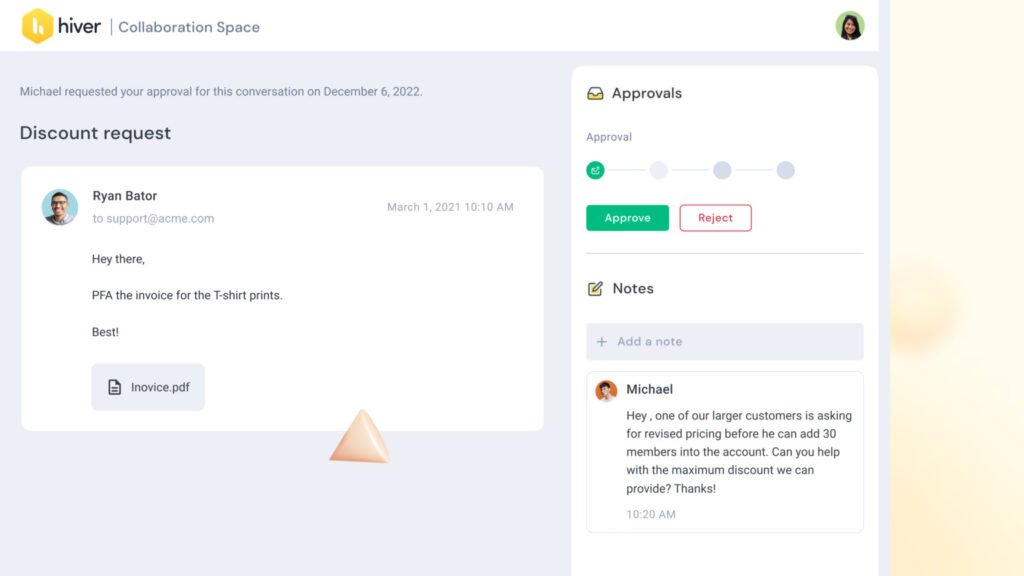

Again, the first step here is evaluating and underlining what processes can be automated based on the AR automation tool you pick. For instance, getting approvals is an important yet time-consuming process. You can set up multi-step approval workflows with your AR automation software, which will ensure there’s no time wasted when you need multiple approvals for invoices.

Underline the repetitive tasks you and your team spend time on every day. These could be:

– Sending follow-ups (notes sent to customers notifying them that their payment is overdue) to late-paying customers

– Generating invoices- Getting approvals for transactions

– Keeping track of customer information, sales orders, and payment details

Create a list of tasks that your accounts receivable automation tool can take up, and set up workflows to automate these processes to save time and minimize the risk of errors.

4. Keep track of your key finance metrics

Keeping track of your key accounts receivable metrics can tell you exactly what’s working for you and what’s not. Without monitoring your key metrics, you cannot optimize your cash collection strategies and ensure stable cash flow into the company.

A good accounts receivable automation tool can help you track and improve your key metrics. Here are some critical AR metrics to track:

Days Sales Outstanding (DSO): This metric measures the average number of days a company takes to collect its receivables. A low DSO is good because it means that customers are paying quickly. A high DSO can indicate problems with the AR process, such as slow billing or poor collection efforts.

Best Possible Days Sales Outstanding (BPDSO): This metric is a best-case scenario of how quickly a company will collect if all bills are paid on time. It can be compared to the actual DSO to see how much room for improvement there is.

Average Days Delinquent (ADD): This metric measures the average number of days invoices are past due. A high ADD can indicate problems with the AR process, such as slow billing or poor collection efforts.

Accounts Receivable Turnover Ratio (ART): Measure how quickly a company turns over its receivables. A high ART is good because it means the company collects its receivables quickly and generates cash flow.

Collections Effectiveness Index (CEI): This metric measures the efficiency of the AR process. A high CEI is good because it means the company collects its receivables effectively.

Bad Debt Ratio: This metric measures the percentage of receivables that are written off as uncollectible. A high bad debt ratio can indicate that there are problems, such as poor credit screening.

Customer Satisfaction: This metric measures customers’ satisfaction with the AR process. Customer satisfaction is crucial because it can affect future sales and referrals.

These metrics clearly show how effectively the AR system is functioning. Any significant change or discrepancy in these numbers should be taken as a signal to dive deeper into AR procedures to identify potential bottlenecks or areas of improvement.

5. Improve cross-team collaboration

Your accounts receivable performance isn’t just the finance department’s responsibility. Every department, from sales to customer service, interacts with clients differently. Establishing a continuous feedback loop between these departments ensures that AR procedures align with client experiences and needs.

For instance, being at the forefront of client interactions, the sales team can offer invaluable feedback on client payment behavior or potential challenges, helping refine AR strategies.

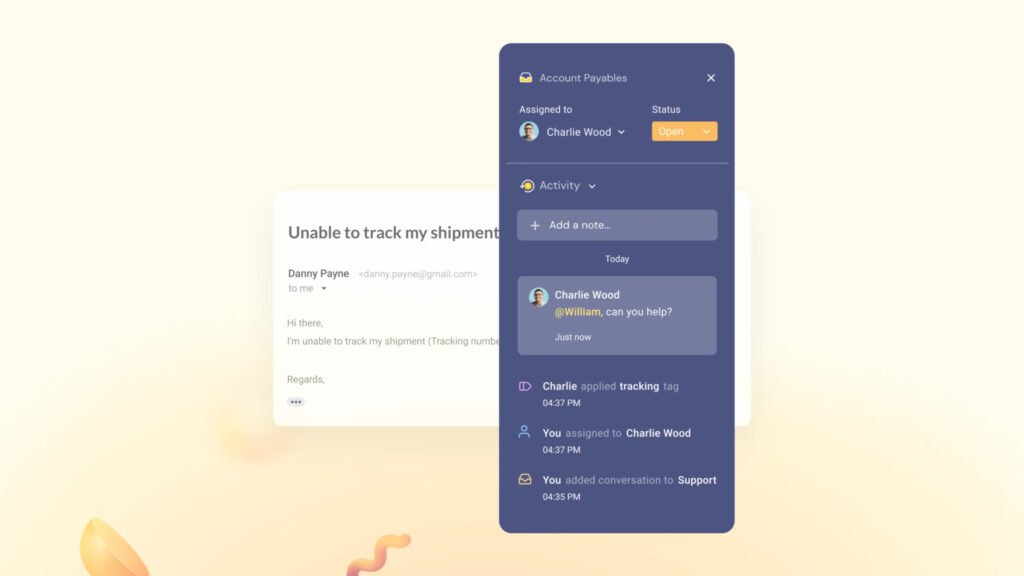

Hiver is a great option if you want to collaborate seamlessly across the organization while taking care of your accounts receivable and payable.

With features such as Notes and @mentions, you can collaborate with any member of your organization seamlessly, with context.

6. Ensure an up-to-date tech stack

Your accounts receivable software should integrate seamlessly with other business systems, such as ERP and CRM platforms, to ensure efficient data transfer and synchronization. Ensure that your AR automation tool has an up-to-date tech stack that works without complications.

Integrating the accounts receivable software with your CRM enables a unified view of customer interactions and financial data. This integration empowers your accounts receivable team to access customer information, such as past invoices, payments, and communications, all from one platform.

7. Be more proactive with your customers

One of the key tenets of efficient AR management is being proactive. If you’re chasing clients after dues have lapsed, it not only strains the client relationship but also hurts the company’s cash flow.

By automating follow-ups, companies can ensure that clients are reminded well in advance of their upcoming payments. This ensures that clients are always informed, reducing the chances of payment delays and fostering a more positive client-business relationship.

Tips to Improve Accounts Receivable Collection

Delays in receiving payments can impact your business. Therefore, improving accounts receivable collection is crucial for maintaining a healthy cash flow. Here are 11 tips to improve your accounts receivable collection process:

1. Ensure Clear and Consistent Invoicing: Create clear and accurate invoices that clearly state payment terms, due dates, and accepted payment methods. Consistency in invoice formatting and presentation helps customers understand and process payments efficiently.

2. Set Clear Payment Terms: Establish clear and concise payment terms upfront. Clearly communicate the due date, late payment penalties, and any discounts or incentives for early payment. This avoids confusion and sets expectations for prompt payment.

3. Prompt Invoicing and Follow-up: Send out invoices promptly after providing the goods or services. As the due date approaches, follow up with friendly reminders to encourage timely payment.

4. Offer Convenient Payment Methods: Provide customers with multiple convenient payment methods such as online payment portals, credit card payments, electronic fund transfers, and traditional methods like checks. Make it easy for customers to pay promptly.

5. Establish Credit Policies: Establish a thorough credit policy that includes credit limits, terms, and conditions. Perform credit checks on new customers and periodically review creditworthiness for existing customers. This helps minimize the risk of extending credit to customers with poor payment histories.

6. Maintain Regular Communication: Maintain open lines of communication with customers. Regularly engage with them to address any concerns they might have. This helps build strong relationships and encourages timely payment.

7. Offer Discounts for Early Payment: Consider offering discounts or incentives for customers who make early or prompt payments. This can encourage customers to prioritize timely payments and improve cash flow.

8. Enforce Late Payment Penalties: Clearly communicate and enforce late payment penalties to discourage customers from delaying payment. Include these penalties in your terms and conditions and consistently apply them.

9. Implement a Collections Policy: Develop a collections policy that outlines the steps and actions to be taken for late or non-payment. This includes escalation procedures, contacting collections agencies if necessary, and pursuing legal action if efforts to collect payments are unsuccessful.

10. Regularly Monitor and Analyze Accounts Receivable: Monitor your accounts receivable regularly and analyze aging reports to identify overdue accounts and take appropriate action. Implementing effective reporting and analysis processes helps you stay proactive in managing collections.

11. Have a knowledge base for payment-related queries: Create a knowledge base for all the FAQs related to payments so that your customers don’t have to reach out to your support/finance team every single time.

Conclusion

Accounts receivable automation software can help you organize and manage your finances more efficiently. These best practices will help your business streamline its finance processes, improve cash flow, and gain valuable insights into your finances.

If you are looking for a finance software that can not only automate your accounts receivable but also manage your payments – all from your Gmail account (read, no need for extensive setup and training),take Hiver for a spin.

Try Hiver and see how it can help your finance team.