The modern-day customer is spoilt for choice. Keeping them satisfied and winning over their long-term loyalty is a lot harder today than it was a few years ago.

The proof is in the numbers. According to Hiver’s “Customer Support Through The Eyes of Consumers in 2020” study, 60% of consumers would switch to an alternate brand after just 2 or 3 bad experiences, and 30% would switch to an alternate brand right after just one bad support experience.

If you think you’d rather not focus on customer loyalty and instead double down on acquiring new customers, there’s more bad news. Acquiring customers has been found to be anywhere between 5 to 25 times more expensive than keeping current customers.

The takeaway here is quite simple: customer loyalty is key to sustaining your business and driving revenue in the long run. But gaining customer loyalty is hard.

But before we get to loyalty, we need to find out if customers are satisfied. How do you ensure that your business’ offerings are aligned with the needs at different stages in the customer journey? More specifically, how do you proactively identify customers who aren’t satisfied and fix their problems before they switch to a competitor?

This is where customer satisfaction surveys enter the picture.

Table of Contents

- Understanding what customers want

- What is a Customer Satisfaction Survey?

- Types of customer satisfaction survey metrics

- Which is the best metric to track in my customer satisfaction survey?

- Choosing the right questions for your survey

- Best practices for customer satisfaction surveys

- How to leverage customer data from your surveys

- 5 Customer Satisfaction Survey Examples from Big Brands

- Conclusion

Understanding what customers want

Ask yourself: why would a customer be dissatisfied with your brand? It could be a product malfunction. A complaint not resolved on time. A poor checkout experience on the website.

Whatever the actual reason, customer dissatisfaction happens when there’s a gap between customer expectations and brand promise.

As brands, it’s important to identify when these gaps happen and fix them in a timely manner. Here’s where customer satisfaction surveys can be useful.

They help you understand what your customers want, how their needs and expectations are evolving, and what they think about your company.

These surveys help you identify drawbacks and shortcomings in your business processes that you otherwise might not have noticed. They equip you with insights into how satisfied or happy your customers are, the likelihood of them switching brands, and more.

When you have this data by your side, it becomes a lot easier to identify unhappy customers, tweak processes and policies with changing customer expectations, and ultimately, earn loyalty.

What is a Customer Satisfaction Survey?

A customer satisfaction survey is a feedback mechanism used by businesses to gauge how their products, services, or overall experience are perceived by customers. A customer satisfaction survey usually consists of a bunch of questions that touch upon various aspects of the customer experience.

For instance, if you’re in the hospitality business, you’d have questions centered on staff hospitality, housekeeping, food, and room cleanliness, amongst other things. This would help you understand what customers think about the different pieces that make up the core customer experience.

Any survey designed to gauge customer satisfaction has a marquee question that helps sum up the customer’s overall experience. This marquee question is directly tied to a customer satisfaction metric – which is usually either NPS, CSAT, or CES.

Here’s an example for added context.

The feedback gathered is crucial for companies to understand their customers’ needs, identify areas for improvement, and make informed decisions to enhance customer satisfaction. By regularly conducting these surveys, businesses can maintain a strong connection with their customers and continuously improve their offerings to meet customer expectations.

Types of customer satisfaction survey metrics

1. The Net Promoter Score

The Net Promoter Score® (NPS®) was introduced by Fred Reichheld in 2003 as a way to measure loyalty and has since become the principal customer metric amongst companies worldwide.

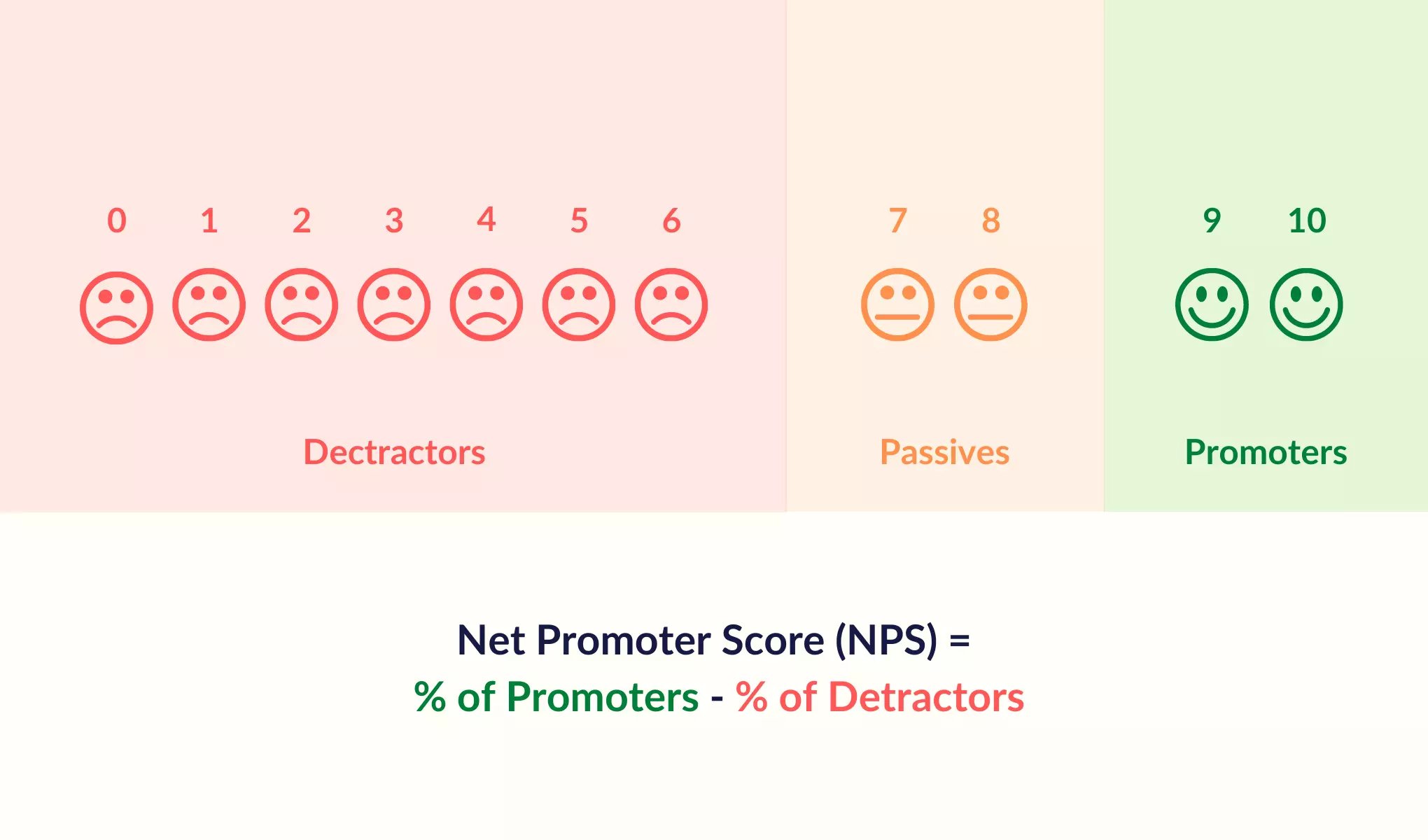

NPS is based on a simple question “How likely is it that you would recommend this company/product/service to a friend or colleague” to which customers respond on a scale of 0 (not at all likely) to 10 (extremely likely).

Customers who rate you 9 or 10 are Promoters aka extremely delighted and loyal customers. The ones that rate you 6 or 7 are termed passives – customers who are just about happy with your business. Any customer who rates you below 6 is deemed a detractor – an unhappy customer who has a high chance of switching to a competitor.

Based on how customers rate you on this scale, NPS is calculated using the following formulae:

For many years, NPS has been the industry’s gold standard metric for measuring customer loyalty. The reason for that lies in its simplicity and its ability to fit into any business scenario.

2. Customer Satisfaction Score (CSAT)

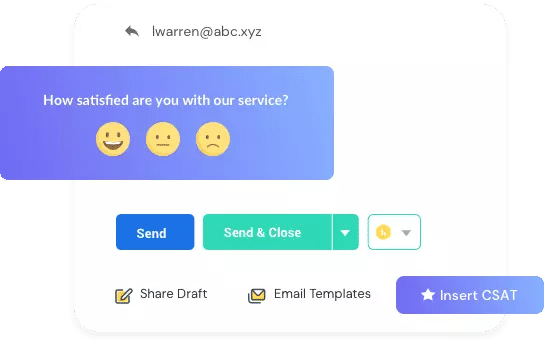

Customer Satisfaction Score (CSAT) is used to find out the proportion of customers who are satisfied and happy in doing business with you.

CSAT surveys can put forth simple questions such as ‘How would you rate your overall satisfaction in using our products/services?’

It needs to be noted that, unlike with NPS, there’s no standard CSAT question. You can tweak the actual question based on the survey you are creating.

Customers are usually asked to answer the CSAT question on a five-point rating scale of 1-5. In some cases, the five-point scale has options such as very unsatisfied, unsatisfied, neutral, satisfied, very satisfied.

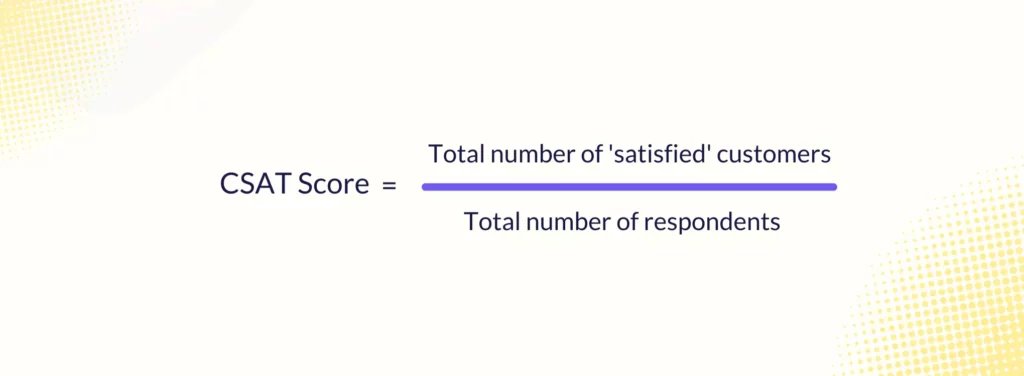

While there’s no universally agreeable method for calculating CSAT, one of the most popular approaches is to take the number of ‘Satisfied’ customers (those who choose Satisfied and Very Satisfied or their equivalent options based on the scale you use) and then divide it by the total number of respondents, before multiplying it by 100.

CSAT is a handy metric to track when you want to know what percentage of your customer base is made up of happy and satisfied customers.

Know more: Customer Surveys in Hiver

3. Customer Effort Score (CES)

The motive behind measuring Customer Effort Score is to find out how effortless any brand-customer interaction is. Did your company make it easy for the customer to achieve what they intended to?

In line with this motive, the Customer Effort Score can be calculated by asking your customers a question like:

‘How easy was it for you to complete your online transaction?’

In this case, companies can use a five-point scale with options such as hardly any effort, low effort, medium effort, high effort, very high effort.

Or, you could pose a statement to customers:

‘The company made it easy for me to complete my online transaction’

Here, you can use a 7 point scale where 1 means strongly disagree and 7 means strongly agree.

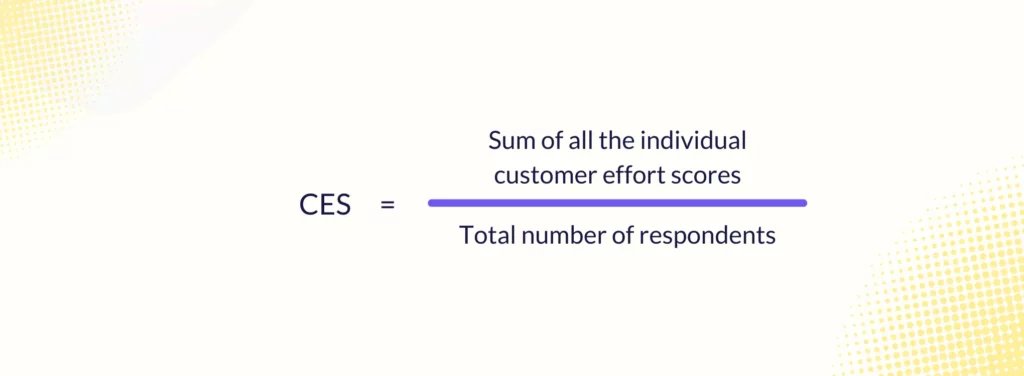

One popular approach to calculate CES is to add up all the individual customer effort scores and divide them by the total number of survey respondents. A high average indicates that your company is making interactions seamless for customers. A low average is reflective of customers facing quite a bit of friction in engaging with your brand.

Which is the best metric to track in my customer satisfaction survey?

All three metrics – NPS, CSAT, and CES – are powerful in their own way as they help easily quantify customer experience.

But, it’s advisable to only measure one metric at a time, in order to get more focused and clear insights. So, how do you choose?

Rather than looking for the best metric to measure, pick the most relevant one. If, for instance, you are running feedback surveys after every customer interaction to understand how effortless the experience was, you should lean towards CES.

In cases where you are running quarterly surveys to get a holistic view of how customers perceive your brand, then either CSAT or NPS is a good option.

Choosing the right questions for your survey

Your customer satisfaction survey is only as good and effective as the questions it comprises.

In fact, the kind of questions and the manner in which you ask them have a direct impact on the accuracy of customers’ survey responses.

So, how do you go about framing questions for your survey? Knowing the different types of customer satisfaction survey questions is something that will help you with this.

1. Yes/No questions

As the name suggests, these questions come with binary answer choices as options. In other words, respondents have to choose either ‘yes’ or ‘no’ as an answer to these questions.

Here’s an example of this type of question:

The advantage of using Yes/No type questions is that they are very straightforward and rarely confuse respondents. The insights you get from these questions would also be extremely easy to interpret.

2. Multiple choice questions

Multiple-choice questions offer multiple options (more than two) for the respondents to pick from. Here’s an example:

These questions are useful in a survey when you want to segment and analyze data based on a particular filter or condition. In this case, you can filter data by one of the options – “Speed at which queries are resolved” – across multiple age groups (say, Gen Z consumers and Millennials) to find out more detailed insights into customer behavior.

These questions require the customer to assess all options presented to them, eliminate some, and pick the one they think is right. That’s quite a bit of mental work.

So, one thing you need to keep in mind is to not overload your survey with multiple-choice questions as they can easily cause survey fatigue.

3. Scale-type questions

Scale questions ask respondents to rate something on a scale of 1 to X. Here’s an example:

From a respondent’s perspective, answering these types of questions is relatively less effort compared to multiple-choice questions.

Another advantage is the fact that these questions look to quantify customer experience. This makes it easier to track and compare data across multiple surveys. For instance, if staff politeness had an average score of 3.5/5 in last quarter’s survey and a score of 4/5 in this quarter’s survey, you could clearly infer how things have improved over the course of six months.

4. Open-ended questions

Open-ended questions do away with options and allow customers to express themselves as they please. They best go hand-in-hand with scale-based questions – helping companies understand the ‘WHY’ behind a particular rating.

As an example, the NPS question ‘How likely is it that you would recommend this company/product/service to a friend or colleague’ can be followed up by an open-ended question such as:

This provides respondents with the opportunity to articulate their thoughts beyond the confines of pre-defined options set by you. Using open-ended questions can help you get more nuanced feedback on your customer experience.

Best practices for customer satisfaction surveys

As important as it is to ask the right questions, there are also other critical factors that influence the accuracy of customer feedback survey results.

So, let’s take a look at some of the best practices that one can follow while creating such surveys.

1. Set a clear goal and objective for the survey

This is perhaps the most fundamental thing you need to do before starting to put together the survey questions.

Identify a clear goal for the survey. Are you looking to track your website experience? Do you want to improve the speed and quality of customer support? Are you interested in knowing what customers thought of their onboarding experience? Or are you curious to know how customer sentiment towards a product/service changes post-purchase?

Having well-defined goals and objectives for your survey sets the tone for everything else you do – right from deciding what questions to ask to determining the length of the survey and more.

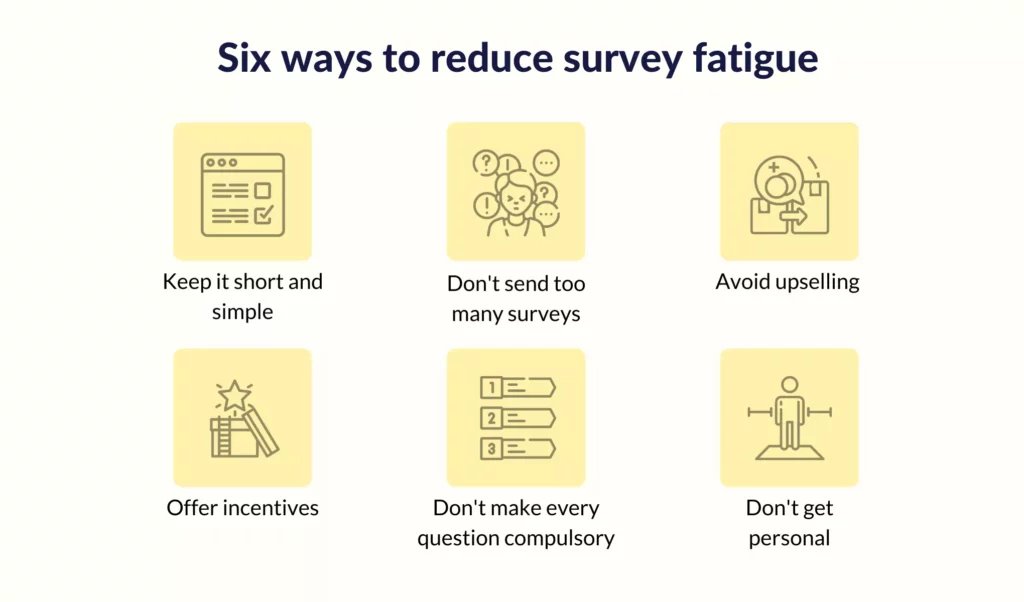

2. Ensure to avoid survey fatigue

Survey fatigue is as real as it gets. Recent research suggests that only 9% of people take the time to answer long surveys thoughtfully. What’s worse is that nearly 70% of respondents said they have abandoned a survey before finishing it.

What’s clear from these findings is that consumers have very little mental bandwidth for surveys. And so, this is something you always need to consider while designing your customer satisfaction survey.

- Have a good mix of different types of questions. This keeps the survey engaging to an extent

- Avoid creating long-winding customer feedback surveys. Based on research from SurveyMonkey, completion rates dropped by 5% to 20% for surveys that took longer than seven or eight minutes to complete. Ensure that your surveys don’t take more than five minutes.

- But, in case you are creating an in-depth survey (in order to get more nuanced insights into customers’ experience),make sure to incentivize your respondents.

3. Know when to send the survey

When you send a survey to a customer, you’re not only asking for their opinion but their dedicated time and effort as well. This is exactly why you’ll need to know ‘when’ to send out your survey.

Unless you reach out to customers at the right moment, there’s a good chance that they simply won’t bother filling out your survey. The timing of the survey would depend on the goals and objectives you have defined in the first place.

If you’re closely looking to monitor the quality of customer support, you might want to send the survey at the end of every support interaction. But say, you’re tracking broader strategic metrics like NPS, you could time it once every quarter.

4. Run a test survey

Before sending out the survey to your customers, it’s recommended that you do a test run with a very small target audience. This would give you a fair idea of the kind of responses you are likely to get from the survey. You’d also be able to gauge the effectiveness of the survey.

Is the survey too long? Do any of the questions come across as confusing? Are the responses highly skewed? If so, what’s causing this?

One of the main reasons to conduct a test run is to get feedback on the survey experience and identity loopholes that might have gone unnoticed otherwise.

This gives you the opportunity to optimize your surveys to boost response rates and improve the accuracy of responses.

How to leverage customer data from your surveys

Collecting customer responses is only one part of the process. To truly align your customer experience with customers’ expectations, you need to put this survey data to effective use.

So, what are some of the things you can do after collecting customer feedback? How do you make the most of this feedback data and use it for the betterment of your organization?

1. Following up and acknowledging respondents

One of the first things you should ideally do after receiving customer feedback is to acknowledge it. Sounds very simple, doesn’t it? You’d be surprised to know, however, that most companies don’t do this. In fact, a recent study found that 90% of companies do not acknowledge or inform the customer that an email has been received.

It’s extremely important to let the customer know that you’ve heard what they have to say. Why? It shows that you care about your customers’ feedback. It goes a long way in reassuring customers that you are always listening and paying attention to their needs.

But, the most customer-centric brands don’t stop there. In addition to informing customers that their feedback has been received, they also explain how they intend to act on the feedback provided.

2. Turn raw feedback into improvement plans

The exercise of creating and running customer surveys is a beneficial one only if it leads to improvement in customer experience.

This is where how you analyze customer feedback becomes important. You should be able to not only unearth actionable insights from survey data, but also categorize these insights, make them consumable for everyone, and forward them to the right teams for action. Doing this is key to ensuring that your processes and policies are always up to date with customers’ needs.

For instance, if you discover that 90% of customers have rated housekeeping 1/5, that’s a serious red flag and you’d want to notify your housekeeping team immediately about it. The team can then review their internal processes to find out ways in which they can improve service, match customer expectations and prevent churn.

3. Action feedback in real-time

Customer feedback from surveys not only helps make strategic improvements to internal processes (long-term changes) but also provides your brand the opportunity to fix issues promptly, in real-time.

The faster you take action on a customer’s feedback, the easier it is to win over their trust and loyalty. It could even make all the difference between them switching to a competitor and championing your brand.

So, how do you action customer feedback in real-time?

- Ensure you are collecting feedback at every possible opportunity to stay on top of the customer’s pulse. In-product feedback could be a great addition to your feedback-collecting processes.

- Use powerful metrics such as NPS or CSAT as part of your survey, to easily gauge customers’ level of satisfaction and loyalty.

- Set up real-time alerts in your customer feedback software that alerts relevant stakeholders at any instance of negative feedback. For instance, if a customer rates you below 6 on the NPS scale, an alert can be sent to the relevant team which can then immediately get in touch with the customer.

4. Constantly iterate the survey

Creating and running a customer satisfaction survey isn’t a one-time job. It’s a constant iterative process.

You need to keep looking for ways to improve response rates and response accuracy. How can you reduce survey fatigue? Will modifying a few questions lead to more actionable findings? How can you tweak survey length to boost the volume of responses?

Also, remember that your customers’ expectations and needs are constantly changing. And so, you will have to always ensure that everything about your survey – from the questions you ask to the design and the touchpoints you use – is up to date with what customers want.

5 Customer Satisfaction Survey Examples from Big Brands

We’ve discussed what customer satisfaction surveys are, the different types of surveys, and some best practices involved with the same. Now let’s look at some real-world examples of customer satisfaction surveys so that you get a clearer idea on how to put one together for your business.

1. Lululemon

Lululemon is an athletic apparel brand that primarily caters to fitness and yoga enthusiasts. Known for its high-quality yoga pants and other sports clothing, the brand appeals to a health-conscious and active demographic, including both men and women. The brand uses a simple star-rating system to understand how the customer feels after a conversation with a staff member. Note how they include the staff member’s name – Pamela, in this case – to add a human touch to the interaction.

2. Airbnb

Airbnb is an American company that operates an online marketplace for lodging – which are primarily homestays for vacation rentals, and tourism activities. Airbnb relies heavily on customer feedback for host credibility.

Their survey email includes a clear, strong CTA which helps drive click-through rates. This button leads you to a questionnaire about your experience using the platform, which looks like this:

3. Uber

Uber is an American company known for its ride-hailing service. Uber’s innovative platform connects riders with drivers, facilitating convenient, on-demand transportation services.

After you finish a ride as a customer, you receive a “rate your Uber” pop-up on the app. The driver too, gets an option to rate the passenger. This makes it fair and transparent for both the driver and the passenger, as these ratings affect both parties’ reputation. A low rating will affect your chances of a ride being accepted in the future.

4. Squarespace

Squarespace is an American website that provides software as a service for website building and hosting. It allows users to use pre-built website templates and drag-and-drop elements to create and modify web pages.

Squarespace has a very simple but effective way of measuring the Net Promoter Score (NPS). They ask how likely you are to recommend the company to your friend or colleague. You’d have to rate this question on a scale of 0 to 10 where 0 is ‘least likely’ and 10 is ‘extremely likely’.

5. Upwork

Upwork is a global freelancing platform where businesses and independent professionals connect and collaborate remotely. Upwork has become one of the largest platforms of its kind, offering a wide range of job categories from web development to creative writing.

Upwork uses something similar to Airbnb. In their survey email, they have a prominent CTA which is consistent with the brand’s colors. You receive this survey email once you fulfill a project on Upwork to understand how your experience was and if you faced any troubles. Additionally, the wording of Upwork’s survey email is such that it feels friendly and appreciative, which helps build customer trust.

Conclusion

Measuring customer satisfaction is one of the first steps you need to take in the path to higher customer loyalty and customer retention. The most simple and straightforward way to do this is to ask for feedback and ask regularly.

Make intelligent use of feedback surveys to gauge your customers’ sentiment towards your brand. Be it a single-question survey or a lengthy questionnaire, you can always find rich customer insights if you design it in the right manner and ask the right questions.

For it is only when you know what your customers truly want can you make their experience delightful.