Top 10 Trends in Accounts Payable for 2024

Table of contents

Freeing up cash trapped in your balance sheet will help you get the funds you need to boost growth and take hold of new investment opportunities as they arise.

Though there are many ways to keep track of cash flow, one core business activity that should not be overlooked is Accounts Payable (AP).

Automation is revolutionizing accounts payable, a function traditionally reliant on manual processes in many companies. According to a survey by the Institute of Financial Operations & Leadership (IFOL)—currently, only 9% of AP departments are fully automated, but this figure is set to rise significantly by 2025, with two-thirds of finance professionals anticipating full automation.

Technological advancements, including Artificial Intelligence (AI),Machine Learning (ML),and cloud platforms, are driving this transformation, enabling faster and more efficient invoice handling and payment processing.

A 2023 report indicates that 64% of companies that have implemented AP automation are processing more invoices with the same size team. This highlights the need for modernizing AP processes and incorporating advanced technologies. While some of the recent trends from previous years are still unfolding, we’re taking a look at the biggest accounts payable trends that are set to redefine the AP landscape in the coming months.

Table of Contents

- Top 10 accounts payable trends for 2024

- 1. Hyper Automation in AP

- 2. Investing in AP security

- 3. Enhanced supplier portals

- 4. Integration with ERP Systems

- 5. Real-time payments strengthen supply chain relations

- 6. Integration with compliance platforms:

- 7. Deploying AI in AP is a game changer

- 8. Advanced analytics and reporting

- 9. Eco-friendly Initiatives

- 10. Mobile-friendly AP solutions

- Transform your AP operations today

Top 10 accounts payable trends for 2024

With foundational shifts in technology adoption, let’s delve into the top ten accounts payable trends for 2024 that will help businesses improve their financial operations and stay competitive.

1. Hyper Automation in AP

Hyper automation is poised to transform AP processes by integrating advanced technologies like AI, ML, and Robotic Process Automation (RPA). This trend represents a significant leap beyond traditional automation, aiming to achieve unprecedented levels of efficiency and scalability in invoice processing and payment management.

This approach facilitates:

- Real-time analytics for effective cash flow management and financial forecasting

- Reduction of manual errors through automated data processing

- Secure cloud-based storage for AP document management, fostering improved collaboration and compliance readiness across the organization

- Enhanced scalability to manage fluctuating AP workloads efficiently

2. Investing in AP security

Ensuring the integrity and confidentiality of financial transactions through robust AP security measures has become increasingly critical amidst escalating cybersecurity threats.

According to Verizon’s 2024 Data Breach Investigations Report, human factors contributed to 68% of breaches, including manual errors and falling prey to a social engineering attack. This highlights the urgency for businesses to implement stringent security protocols and enhance employee training to effectively mitigate vulnerabilities in AP processes.

Solutions such as multi-factor authentication, encryption of sensitive data, regular security audits, and continuous employee education are essential to safeguarding AP systems from potential cyber threats.

3. Enhanced supplier portals

Supplier portals are evolving to offer enhanced self-service functionalities, enabling suppliers to independently submit invoices, track payment statuses, and resolve discrepancies. Direct supplier input minimizes data entry errors and ensures accurate invoice processing, leading to fewer payment delays.

By empowering suppliers to manage their own transactions, companies reduce the operational costs associated with AP administration. Moreover, real-time access to payment statuses and invoice details fosters transparency and strengthens supplier relationships.

4. Integration with ERP Systems

Integrating AP solutions with ERP systems enhances operational efficiency by centralizing financial processes, facilitating seamless data synchronization, and reducing redundancies. However, ensuring accurate invoice processing within ERP systems requires aligning vendor invoices with specific data criteria, such as purchase order details or remittance advice.

Discrepancies often arise when invoices lack essential data, leading to extensive follow-up and manual data entry for resolution. Additionally, invoices arrive in various formats, like PDF, XLS, or TIFF, posing challenges in recognition by software and potentially causing delays as invoices are redirected to vendor portals.

Here are actionable steps to mitigate these challenges:

- Implement automated data validation processes to ensure invoices meet ERP system requirements without manual intervention

- Enhance vendor communication to facilitate the submission of complete and accurate invoice data, thereby reducing discrepancies

- Invest in ERP solutions capable of handling multi-format invoice processing to minimize redirection delays and streamline data entry

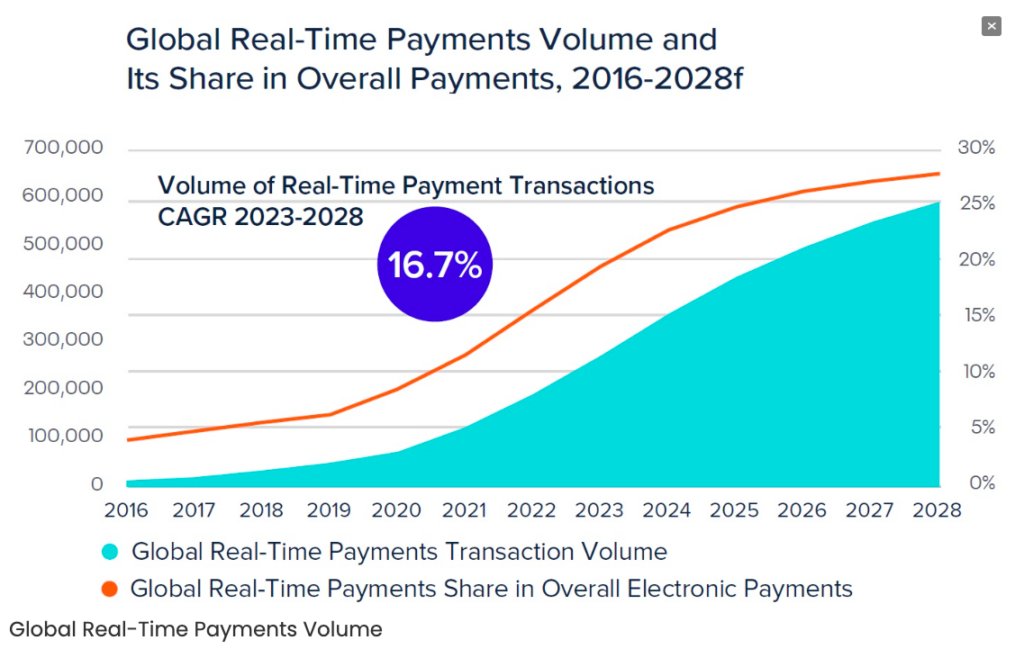

5. Real-time payments strengthen supply chain relations

The demand for real-time payments is growing, driven by the need for faster, more efficient transactions. Real-time payment solutions provide immediate fund transfers, enhancing cash flow management and supplier relations. By consistently meeting payment obligations, businesses can differentiate themselves and potentially negotiate discounts with suppliers offering early-payment incentives.

6. Integration with compliance platforms:

By centralizing compliance efforts within the AP workflow, organizations can mitigate risks associated with non-compliance, strengthen audit capabilities, and maintain a proactive approach to regulatory changes. This integration enables seamless data management and reporting, facilitating quicker responses to compliance inquiries and audits.

7. Deploying AI in AP is a game changer

By integrating AI into AP systems, organizations streamline workflows, reduce operational expenses, and allocate resources more strategically. As AI continues to advance, it refines AP processes, ensuring they are more efficient and dependable in managing financial transactions and interactions with vendors.

Key applications of AI in AP include:

- Automated data extraction: AI and Optical Character Recognition (OCR) technologies extract invoice information, reducing errors and speeding up processing

- Invoice matching: ML algorithms align invoices with purchase orders, ensuring compliance and reducing discrepancies

- Predictive analytics: AI analyzes data for cash flow forecasts and optimal payment schedules

- Virtual assistants: AI-driven chatbots manage vendor communications and resolve payment issues efficiently

8. Advanced analytics and reporting

Advanced analytics tools are now integral to AP systems, providing in-depth insights into spending patterns, payment cycles, and supplier performance. By leveraging these insights derived from financial data, businesses can enhance decision-making processes, optimize AP workflows, and achieve strategic outcomes.

Here are ways in which advanced analytics can aid the AP process:

- Data analysis identifies discrepancies and errors early, ensuring invoices and payments are processed correctly

- Insights into spending patterns and cash flow trends enable proactive financial planning and budget management

- Automation based on data insights reduces manual tasks, speeding up invoice processing and approval cycles

9. Eco-friendly Initiatives

Sustainability is increasingly important for companies seeking to reduce paper usage and carbon footprints. The trend towards a paperless workplace is poised to expand further in 2024, especially in areas like accounts payable, where automation plays a crucial role in minimizing paper usage through electronic invoicing and payments.

Now is the time for Electronic invoicing (e-invoicing),Smart PDF, and Smart Coding. These solutions reduce manual handling and accelerate invoice processing times, further supporting sustainability goals by minimizing paper usage and carbon footprints.

10. Mobile-friendly AP solutions

Mobile accessibility is increasingly crucial for AP departments, allowing staff to approve invoices, track payments, and resolve issues on the go. Mobile-friendly AP solutions enhance flexibility and responsiveness in managing financial operations. With real-time updates and instant notifications, staff can promptly address pending invoices and monitor payment statuses.

Transform your AP operations today

By keeping up with these accounts payable trends for 2024, businesses can take their financial operations to new heights, ensuring profitability and competitiveness in the evolving marketplace.

AP teams have also started using email management tools to enhance AP efficiency by automatically routing invoices to designated recipients based on predefined rules for review and approval.

Embracing digitization and leveraging collaborative tools such as Hiver for AP management have multifold benefits, such as increasing processing accuracy, accelerating invoice processing, and optimizing payment timing.